And when these new businesses come in, there are huge advantages for the early birds. And when you’re an early bird, there’s a model that I call “surfing” – when a surfer gets up and catches the wave and just stays there, he can go a long, long time. But if he gets off the wave, he becomes mired in shallows. But people get long runs when they’re right on the edge of the wave, whether it’s Microsoft or Intel or all kinds of people.

Charlie Munger

Today I am gonna be writing about a specialty chemicals company that has shown a compounded growth rate of 60% in one of it’s verticals. The growth of this vertical is being driven by demand from lithium ion batteries, which are critical to the continuation of this EV wave.

We’ll take Tesla’s sales, currently the biggest and the most undisputed successful electric vehicle company in the world, as a proxy for what’s happening in the EV industry. Here’s how they’ve grown over the last decade plus.

The electric vehicle wave is here to stay. Here’s a chart that shows the kind of explosive growth EVs have been seeing, worldwide. And we are just getting started in EVs. EVs were just 8% of total cars sold in 2021. Can this number become 50% over the next decade? Nobody knows!!

Demand for EVs in turn is leading to demand for Lithium Ion batteries.

“What about the next 10 years? I’ll be surprised if it’s not over 100 million in 10 years.”

Elon Musk about the future volumes of Tesla – Aug 2022

In 2022, Tesla is likely to produce 2 million cars. And Musk thinks they’ll be able to produce 50x that number of cars in 10 years.

50x in the next 10 yrs!! To grow 50x in 10 yrs, Tesla will need to grow at 50% per annum, every year for the next decade. To put things into perspective, the total number of cars (ICEs + EVs) registered in the US in 2021 was 290 million (This includes old as well as new cars). And the EV market leader there, is selling a miniscule 2 million cars this year. Wow!!

And here’s what he recently said about Lithium batteries!!

The Indian business we are interested in, is Gujarat Fluorochemicals, a 37 thousand Crs Market Cap co. that I expect, could surf the EV wave neatly, over the next few years, or at least it looks so, at the moment. So GFL makes stuff that goes into Lithium Ion batteries.

Let me start with a notice that GFL gave to it’s customers in April 2021.

Basically they were saying:

- There was high demand for PVDF & FKM and will continue to remain so.

- R142b was in acute shortage, globally!!

What exactly are FKM, PVDF & R142b? What does this stuff have to do with the EV wave? I’ll come to that in a minute.

First, here’s an overview of GFL’s backward integration, which it has painfully developed over many many years.

Let me start with a story.

So back in 1987, countries basically came together and decided to gradually phase out CFCs that were killing the ozone layer. R22, which GFL also makes, is one of the gases that was phased out. R22 can still be made by cos and used as a raw material for other stuff.

If a competitor needs to make PVDF and FKM, they’ll need R22, R142b (which again is in high demand worldwide, without enough supplies).

So what is PVDF? And where does it fit in the EV battery chain?

PVDF is a fluoropolymer that is used in stuff that requires the highest purity, as well as resistance to solvents, acids and hydrocarbons. Below is an image which describes the stuff that goes into batteries.

More on PVDF Binders and Coatings from Solvay, another global player that is into fluoropolymers.

Moving on to FKM. What exactly is it?

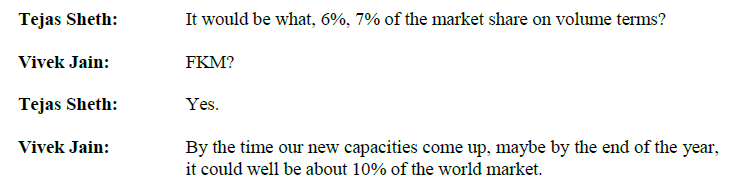

Why is FKM, another fluoropolymer, in demand? And what kind of market share does GFL have in this product? The answers are in their July 2022 concall.

And they will have at least 10% worldwide market share in FKM.

Okay so what’s the big deal in having a 10% market share? Can’t another set of players just come in and make more FKM and other stuff that GFL makes?

Here’s one more from another site, which says building chemical plants will take longer than building semiconductor plants. Semiconductors are another industry where FKM is used. This comes from an executive from Daikin which is a major fluoropolymer manufacturer.

What stops a potential new entrant from coming in with new capacities here?

Besides, GFL started out as a commodity Fluoropolymer player and over a course of time created a large no. of Fluoropolymer grades specific to their customer. This leads to a lot of customer stickiness and makes life difficult for a potential new entrant.

One of the raw materials that is not available for producing FKM, PVDF and other fluoropolymers is R142b, a refrigerant gas that not many cos on the planet are allowed to manufacture. New approvals for these gases take a long long time because of the ozone depleting potential of these gases.

And here’s a co. that will not only use R142b for captive consumption but also export it. Talk about having your cake and eating it too.

Essentially these facts mean fluoropolymer cos worldwide are:

- In huge demand, thanks to rising consumption of Lithium Ion batteries.

- There are not enough capacities that can meet this demand.

- Players that make both, the raw materials as well as the end product, are at a huge advantage, compared to the others.

- It takes many years, lot of effort, approvals and expertise to add capacities.

This puts players like GFL in a sweet spot. Btw GFL is the only company in India to make and export some of the products I have written about and other spec chem players in India are likely to take a while before they can catch up.

One of the things I’ve learnt as an investor is that we should view businesses as stories that are unfolding and not as pictures of still water. A lot of these growing businesses spring up happy surprises when you least expect them to. I am sure very few investors or perhaps nobody, a few years ago, would have imagined PVDF would become such a big business for GFL.

Yet, here’s how the movie unfolded. Starting with PTFE suspension, they gradually moved to PTFE Emulsion, FKM, PFA, FEP, Additives and eventually to PVDF.

And here’s how the management is expecting their Specialty Chemicals business to play out. Specialty Chemicals which is a 300 Crs business in June 2022 could potentially transform into a 2000+ Crs business over the next few years, thanks to battery chemicals such as LiPF6 that they are planning to make in the near future.

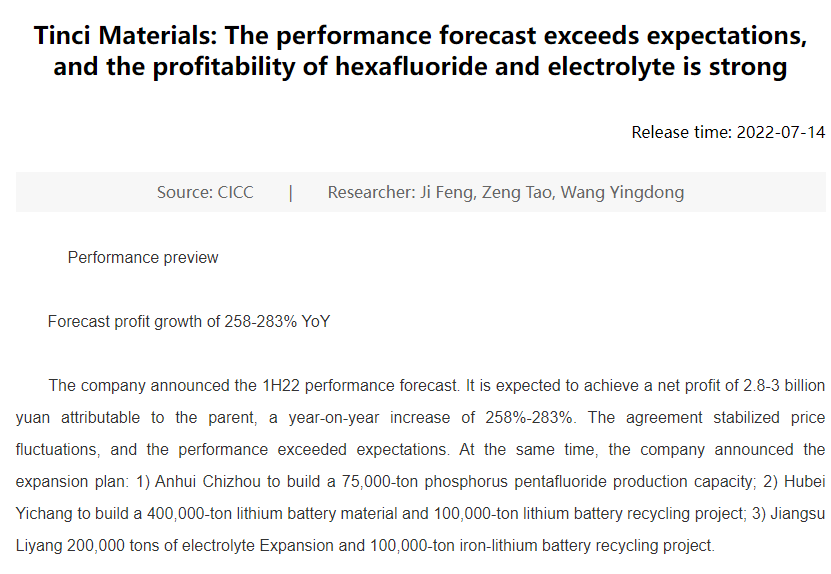

Here’s a Chinese player, Guangzhou Tinci Materials, which makes LiPF6 and below we can see the kind of supernormal growth they are seeing in their business.

And Tinci’s business in no mood to slow down. Here’s a recent news article which shows the kind of exponential growth they are seeing. The article also states they are expanding capacities.

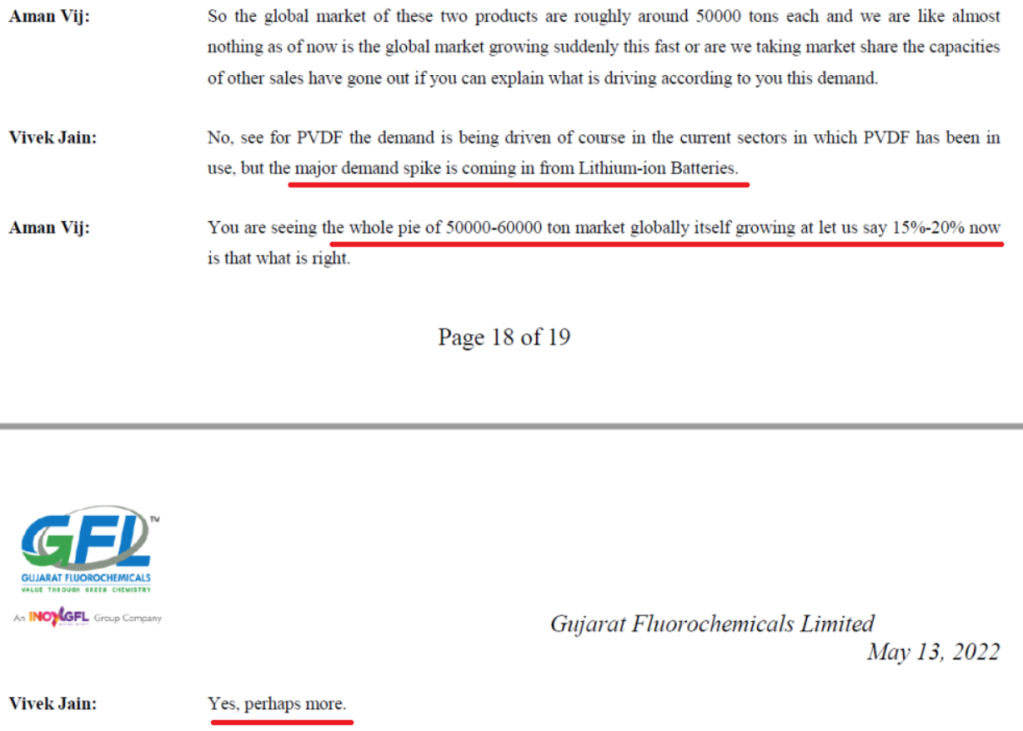

The fact that the lithium ion battery market is growing at more than 20% was also confirmed by GFL’s management in their May 2022 concall.

The future will tell whether or not GFL can execute their LiPF6 business the way they have done for PVDF & FKM. If LiPF6 works out well, that’ll be an icing on the cake.

New Fluoropolymers, which consist of PVDF & FKM are just 18% of their TTM sales. I foresee this division becoming a larger chunk of the overall pie in the near to medium term. Specialty Chemicals which would consist of LiPF6 in the future, is 7% of TTM sales and that could become a big one as well.

Risks

- Corporate guarantees worth 1000 Crs+ given to Inox Wind – Inox Wind is another entity from the same promoter group. This one has been a bee in the bonnet for GFL’s stock for quite sometime. Promoters have committed to return this money to GFL by March 2023. Any other hanky panky in this area would be a show spoiler.

- Disruption risk – If EVs start adopting other technologies owing to supply chain issues in PVDF / FKM and other fluoropolymers, this would lead to GFL’s business getting hurt. As of today, I haven’t been able to find any evidence to support this argument. But then technologies & supply chains can evolve rapidly given there is enough moolah involved, and one can never say for sure.

- Fire hazards – Last year there was a fire at one of the GFL’s plants and that led to a shut down of that plant for sometime. Although it was covered by insurance, something similar happening again could spook investors.

- Environmental hazards / gas leaks in the future.

- LiPF6 business not kicking off as expected.

- Other unpredictable risks – Risk is what is left over after we’ve thought about everything else.

More availability leads to more consumption

Charlie Munger once said “You’ll drink a hell of a lot more Coke if it’s always available.”

Charlie was implying the power of Coca Cola’s worldwide distribution network. Just because Coke is available everywhere, we tend to consume more of it. Imagine someone keeping a new Coke bottle at your and all your colleagues’ desks every day. Without doubt, it will lead to more sales for Coke, no matter how health conscious you or some of your colleagues are.

Here’s one more from one of my favorite self-help books.

“Environment is the invisible hand that shapes human behavior. Despite our unique personalities, certain behaviors tend to arise again and again under certain environmental conditions. In church, people tend to talk in whispers. On a dark street, people act wary and guarded. In this way, the most common form of change is not internal, but external: we are changed by the world around us.”

Atomic Habits

It’s easy not to read a book when the bookshelf is in the corner of the guest room. It’s easy not to take your vitamins when they are out of sight in the pantry. When the cues that spark a habit are subtle or hidden, they are easy to ignore. If you want to remember to take your medication each night, put your pill bottle directly next to the faucet on the bathroom counter. If you want to practice guitar more frequently, place your guitar stand in the middle of the living room. If you want to remember to send more thank-you notes, keep a stack of stationery on your desk. If you want to drink more water, fill up a few water bottles each morning and place them in common locations around the house.

Atomic Habits

Will something similar happen with EV adoption? What will happen when charging stations become available at more and more parking lots, malls, restaurants, offices and apartment car parks? Chances are high that if the external environment makes more charging stations available, it will lead to faster adoption of EVs.

And your guess is as good as mine on what kind of an impact this will have on the financials of EV beneficiary companies such as GFL.

Disclosure – I have a position in this company and my views are certainly biased. This blog is not to be construed as an investment advice. Please consult your investment advisor before investing.

Disclaimer: This is NOT investment buy/sell/hold advise. I am not SEBI registered. May change stance on above business anytime with new developments and/or new insights, and/or overall market conditions. May NOT be able to update periodically. Please do your own diligence and/or take professional advise, before investing.

Barath Mukhi

12-August-2022

Correction – May 2023

Only recently I realized, the making of PVDF does not require R22. This was pointed out to me by a friend. The other thing about making R22 is not restricted for feedstock use.

Essentially this means, there are not as many restrictions on the supply side as I had expected. I continue to stay invested and bullish on the company. As stated earlier, I may change stance on above business anytime with new developments and/or new insights, and/or overall market conditions. May NOT be able to update periodically. Please do your own diligence and/or take professional advise, before investing.

Till date we just knew about Tata chemicals which is into production of lithium used for EV batteries.

Your detailed above article gives lots of insight about what goes into manufacturing of EV car batteries.

Your article is well understood and make its simple for people like me as it is supported by relative examples.

LikeLiked by 1 person

Great article . One question though … US population is 330 million or so. Are you sure that 290 million cars were sold in USA in 2021 ??

LikeLike

Apologies. I seem to have misinterpreted that one. 290 Million vehicles weren’t sold but according to the Hedges Company, there were 286.9 million registered cars in the US in 2020. That number includes existing as well as new cars. I’ll update the article. Thanks for pointing out 🙂

LikeLike