Remember the market cliché about some of the best track records coming from those of dead people’s inactive portfolios? This comes from a supposed study that was done by Fidelity, in which they noted an internal performance review on accounts to determine which type of investors received the best returns between 2003 and 2013. The customer account audit revealed that the best investors were either dead or had forgotten about their portfolios.

This happens because emotions and opportunity costs are not a factor in dormant portfolios. Does that mean, one should not try to maximize returns from one’s portfolio by switching to better ideas? I don’t think that would be the perfect thing to do, considering the dormant portfolio data. I’ll tell you why. Imagine you were an investor in Wipro in Feb 2000 and somebody told you about inactive portfolios doing better than the active ones and based on that you’d decided not to sell. You’d have had 20 years of zero returns while the indices ran up multi-fold.

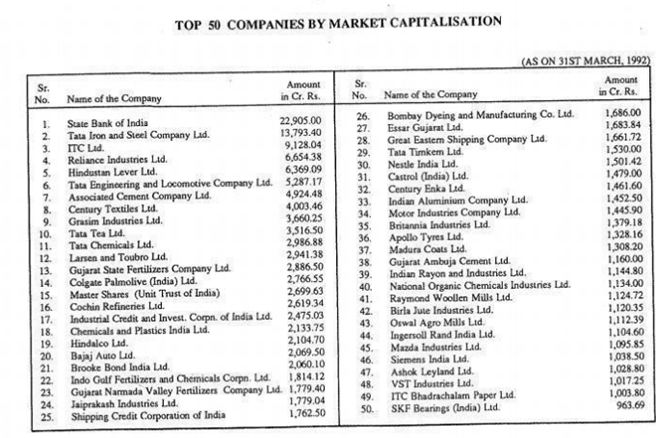

Very few companies survive the relentless onslaught of competition, technology, changing consumer preferences, changing government regulations and various other factors. See for example, the below list of top 50 companies by market capitalization in 1992.

Most of the above got replaced by better, sexier, smarter companies. And, most of the ones that did survive in today’s top 50, did so because of issuing new shares. Take State Bank of India for example. From a market cap of 22900 Crs in 1992 to 318,000 Crs today, SBI’s market cap grew at a pitiful 9.5% CAGR. I am not even getting into equity dilution which would chop shareholder returns down to much lower single digits.

Or take ITC, a much debated hot stock. ITC’s market cap went from 9000 Crs to 2.6 Lac Crs, delivering a return of 12% CAGR, excluding dividends. That ITC would grow at a faster clip, 2021 onward, when it is 28x bigger, and is likely to be much more bureaucratic than it was in 1992, will possibly become a case study in hope based “long-term” investing, in the future.

Going back to 1992, as investors who believed in the India growth story, and who wanted to maximize their ROI, why would we have stayed invested in SBI/ITC when there were much better fish in the pond, provided one knew where to look? Shouldn’t we have been looking for faster growing high ROE companies, than the below large caps?

| Company | 1992 | 2021 | CAGR (excluding dividends,dilution,spin-offs) |

| State Bank of India | 22905 | 318787 | 10% |

| Tata Iron & Steel | 13793 | 86385 | 7% |

| ITC | 9128 | 259594 | 12% |

| Reliance Industries | 6654 | 1310616 | 20% |

| HUL | 6369 | 544606 | 17% |

| Tata Engineering & Locomotive | 5287 | N/A | N/A |

| Associated Cement | 4924 | N/A | N/A |

| Century Textiles | 4003 | 5225 | 1% |

| Grasim Industries | 3660 | 92495 | 12% |

| Tata Tea | 3516 | N/A | N/A |

| Tata Chemicals | 2986 | 18958 | 7% |

| Larsen & Toubro | 2941 | 196339 | 16% |

| Gujarat State Fertilizers Company | 2886 | N/A | N/A |

| Colgate Palmolive | 2766 | 41860 | 10% |

| Master Shares (Unit Trust of India) | 2699 | N/A | N/A |

| Cochin Refineries | 2619 | N/A | N/A |

| Industrial Credit and Investment Corporation of India (ICICI) | 2475 | N/A | N/A |

| Chemical and Plastics India | 2133 | N/A | N/A |

| Hindalco | 2104 | 73500 | 13% |

| Bajaj Auto | 2069 | 104174 | 14% |

| Brooke Bond India | 2060 | N/A | N/A |

| Indo Gulf Fertilizers and Chemicals Corp | 1814 | N/A | N/A |

| Gujarat Narmada Valley Fertilizers & Chemicals | 1779 | 4456 | 3% |

| Jaiprakash Industries | 1779 | N/A | N/A |

| Shipping Credit Corporation of India | 1762 | N/A | N/A |

| Bombay Dyeing | 1686 | 1468 | 0% |

| Essar Gujarat | 1683 | N/A | N/A |

| Great Eastern Shipping Company | 1661 | 4513 | 4% |

| Tata Timkem | 1530 | 9447 | 6% |

| Nestle India | 1501 | 159778 | 17% |

| Castrol India | 1479 | 12166 | 8% |

| Century Enka | 1461 | 549 | -3% |

| Indian Aluminium | 1452 | N/A | N/A |

| Motor Industries | 1445 | N/A | N/A |

| Britannia Industries | 1379 | 84415 | 15% |

| Apollo Tyres | 1328 | 14280 | 9% |

| Madura Coats | 1308 | N/A | N/A |

| Gujarat Ambuja Cements | 1160 | 58557 | 14% |

| Indian Rayon and Industries | 1144 | N/A | N/A |

| National Organic Chemicals | 1134 | N/A | N/A |

| Raymond Woollen Mills | 1124 | N/A | N/A |

| Birla Jute Industries | 1120 | N/A | N/A |

| Oswal Agro Mills | 1112 | 132 | -7% |

| Ingersoll-Rand (India) | 1104 | 2116 | 2% |

| Mazda Industries | 1095 | N/A | N/A |

| Siemens India | 1038 | 64449 | 15% |

| Ashok Leyland | 1028 | 33480 | 13% |

| VST Industries | 1017 | 1017 | 0% |

| ITC Bhadrachalam Paper | 1003 | N/A | N/A |

| SKF Bearings (India) | 963 | 10757 | 9% |

Suppose an investor forgot about his large cap portfolio in 1992, 29 years later, in 2021, he would have realized what a poor idea it was, to leave his portfolio dormant. The top performer, Reliance Industries, delivered 20% CAGR, excluding dividends, while most of the remaining companies either ceased to exist or delivered single to lower double digit returns. I am not getting into what happened to companies where data is not available. And I am not inclined to calculate dividends either because we want to look at the most efficient way of calculating returns quickly. My hunch is that, at best dividends would add 2-3% to the above returns. It is not rocket science to understand that active investors who kept learning about companies did much better than the cumulative returns delivered by this dormant portfolio, including dividends.

Conclusions

- The answer to Buy and hold vs Buy and forget lies somewhere in between. Continue to hold companies that keep executing. For the ones that don’t, switch to better alternatives, because opportunity costs are real.

- Buy and monitor beats Buy and hold any day. As Ian Cassel says “Fall in love with companies that execute but be prepared to divorce quickly.”

- The above data is only for large caps. People typically invest in large caps for the certainty and clarity, the big companies provide. I agree with Ken Fisher, who once said “Clarity is almost always an illusion—a very expensive one.” As ROI focused investors we are better off investing in mid and small caps, even after adjusting for the risk involved in smaller companies.

- Most things in the market are contextual. What works in the west doesn’t always work in India. Buy and hold may have worked in the case of Fidelity’s investors who forgot/were dead. It certainly has not worked in Indian large caps.

Barath Mukhi

30th-March-2021

Good data points but the conclusion is a little iffy, if I may say so . Without Internet and SEBI in existence , finding out high ROE small caps in 1992, would have about 10x chances of coming a cropper . what if you had got onto Rolta

or Satyam ? What if you had bought the global trust bank ? While if you had ITC from 2000 to till now ,you would have had a 15%(including dividends) CAGR stock .

I think if you manage to get hold of a list of small caps like the one above , you would see more vanishing stocks . I say this because only last week my uncle pulled out his old share certificates from the 1990s and we had to burn about 23 out of 25 because all had gone bust .

LikeLike

Based on my analysis of historical multi baggers, there are wealth creators available in every market. In most cases, what is usually not available is the hard work & the techniques needed to uncover them.

To quote an example, Vijay Kedia was one investor (back then, probably only as good as some of us today) who made a ton of money in that era and one of his picks was Punjab Tractors https://economictimes.indiatimes.com/markets/stocks/news/kolkata-man-with-a-smile-best-at-spotting-multibaggers-on-d-street/articleshow/58784177.cms?from=mdr

Here’s how Punjab Tractors’ market cap went.

1990 62 Crs

1991 96 Crs

1992 266 Crs

Below, I quote some more:

Satyam’s market cap

1995 135 Crs

1996 122 Crs

1997 168 Crs

1998 708 Crs

1999 4410 Crs

2000 24906 Crs

Hero Honda

1995 449 Crs

1996 579 Crs

1997 599 Crs

1998 1948 Crs

1999 3594 Crs

2013 22790 Crs

LikeLiked by 1 person

Fair enough and I agree that Indian markets were not mature enough to go for long hold in 90s.But dont you think if someone bought pidilite or asian paints in 2000 would he have any reason to sell ? Say you had ITC worth a lakh in 2000 you would get about 25k in dividends in 2020.Why would you sell ?

I also dream of getting hold of a 50 bagger but at this point of time I would probably sell it at the first roadbump even if I have one(already have sold two 5 baggers in past 1 year after 60% returns ) . Having the conviction to hold stocks for long time takes experience .For all of Buffets advice he had about 20 years experience before he became famous enough to preach and even Mr. Kediya had 12 years in the market before punjab tractors. Question is ..can anyone start mature enough to spot the gold among the gilt ??

LikeLike

Spotting the best stocks out there takes some experience & quite some work. Even after that one can’t foresee which of his/her picks will be multi baggers.

That being said, it makes sense to follow & internalise the ideas articulated by authors like Peter Lynch, William O’Neil, Basant Maheshwari, Raamdeo Agrawal, etc. These are people whose ideas I resonate with, although I don’t agree with everything some of them say.

In my article, I have mentioned, “Continue to hold companies that keep executing.” By executing, I mean, companies that deliver both ROE as well as above average growth rates.

Holding Asian Paints/Pidilite would depend upon one’s opportunity costs.

For a passive investor, the opportunity costs are lower and hence it would make sense to hold these companies.

For an active investor looking for high CAGR, it would make sense to forego an Asian Paints/Pidilite and look for companies that go up multi-fold in a span of 3-4-5 years or thereabouts.

LikeLike