There is this notion most of the people who are starting out in their jobs, have. “Once my salary becomes big enough, let me take a home loan and get settled down in life. Why pay rent to somebody else?” After all, having your own nest, and providing shelter to your family, is an innate desire most creatures are born with. Birds build nests, for example.

Let’s dive into what are the implications of this wrong idea, most of us are either born with, or are directly or subconsciously taught. Assuming, some of you are in a decent paying job, where you can save enough to comfortably pay prospective home loan EMIs, today or in the near future, should you buy that house you dream of? If yes, what is the ideal time to buy it?

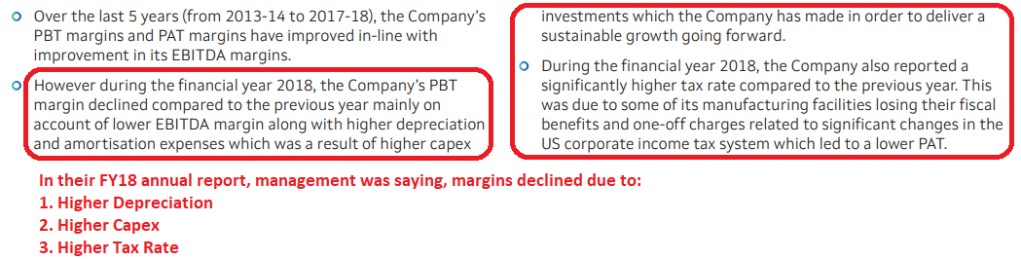

Taking a home loan is the exact opposite of how Robert Kiyosaki defines an asset. An asset is an investment vehicle that puts cash in the hands of it’s owner. Conversely, a leveraged property takes away cash out of your pocket, every single month. Notice how he puts mortgage under liabilities/expenses.

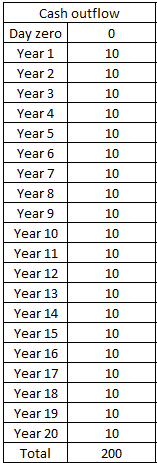

To make things simple, let’s suppose you have a friendly next door home loan lender who offers you a 100% loan (no down payment) on a sexy new flat in the neighbourhood that has caught your eye. Moreover, he tells you, hey you can pay me just the interest for now and at the end of 20 years, you can sell the flat and repay me the principal.

- Cost of flat – ₹ 1 Crore

- Rate of interest – 10% per annum, fixed, for the next 20 years.

- EMIs per year – 10 Lacs

- Rental yield – 3% per annum with a 5% escalation every year

- To simplify, I have ignored tax savings from the home loan because without a home loan, one can still save taxes using HRA and other 80c deductions.

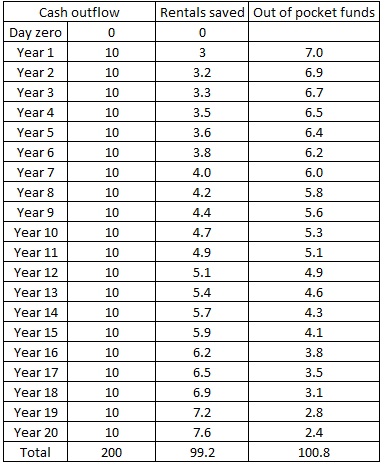

So your cash outflow would be 2 Crores, over 20 years.

From this outflow, let’s deduct the rentals you’d save by staying in the flat. Annual rental yields in most cities are in the range of 2-5%. I’ll take 3% (25k a month in year 1) as the average rental yield, with a 5% escalation per annum.

From the outflow of 2 Crores, you’d have saved 1 Crore towards rentals, that you’d have paid, had you chosen NOT to buy that flat. So after factoring in rentals saved, your actual out of pocket funds are 1 Crore rupees.

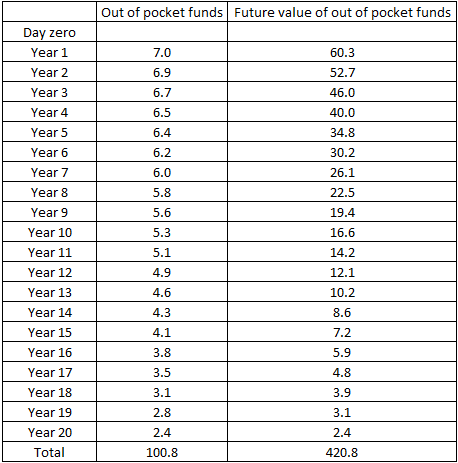

But hey there’s a catch. Bring in the aspect of future value of money aka opportunity costs aka compound interest.

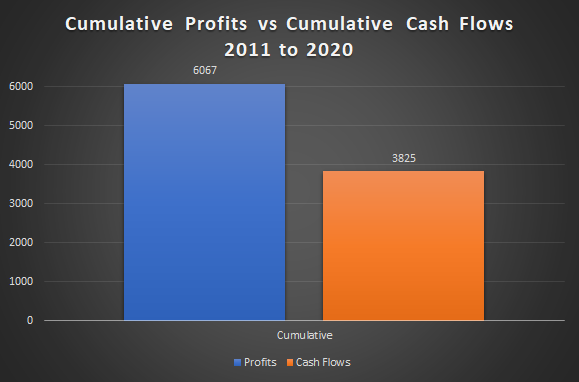

So, had you chosen to NOT buy that flat and put that money into a mutual fund SIP which earned you just mediocre 12% returns per annum, your opportunity costs would work out to 4.2 Crores. Effectively this means that the flat that is selling for 1 Crore today needs to sell at least for 5.2 Crores, 20 years later, for it to break even with returns from a 12% earning mutual fund SIP. I would imagine, that a 20 year old flat will sell for 5.2 Crores, in 2040, would be considered wishful thinking.

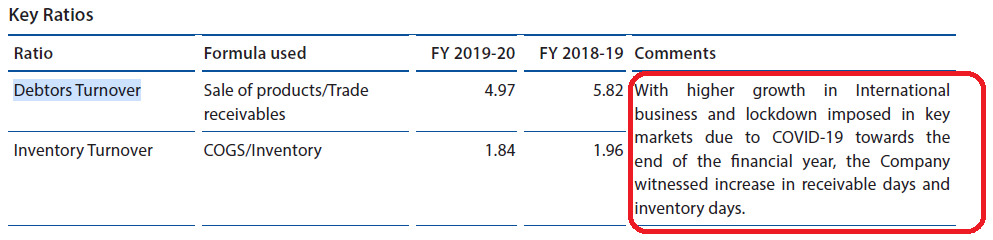

Now let’s come back to the real world. Why does it not make sense, on average, to take a home loan at 8%? Because rental yields is India are a paltry 3-4% per annum whereas home loan interest rates are, on average, 8% and above. Effectively, this means, the market value of your flat needs to appreciate by at least 4-5% per annum (8% interest rate minus 3% rental yield) in order to cover the interest costs of that home loan. Anything above and beyond this 5% is your gain. If it doesn’t appreciate above this 4-5% threshold, you’ve incurred permanent loss of capital.

The idea is to NOT ignore invisible opportunity costs just because those are not out of pocket costs and just because they don’t show up in your mental balance sheet. The invisible sometimes matters a lot more than what is seen. The invisible is like the dog that did not bark in the famous Sherlock Holmes story.

I can already hear some of your psychological arguments against the idea of not buying a house.

- What if I lose my income stream some day? Well this holds good even if you were to have that home loan on your head. Without income, one may still struggle to pay their monthly rent. Conversely, one is more likely to be better off with a lot of liquid investments, which are a result of prudent investing, over time. And these investments happened because one did NOT get suckered into that sweet home loan deal.

- There’s an emotional value attached to an “own house” that one will probably not experience in a rented house. I agree. But then, this emotion comes at an invisible cost attached to it. Think of all the things that your family could otherwise do, with all the money that you’d earn by putting money into a mediocre SIP which earns just 12%. And here I have taken 12% instead of the benchmark 15%, which is expected from equity mutual funds in India.

Another idea that gets conveniently ignored, when buying a house was articulated by Warren Buffett several years ago.

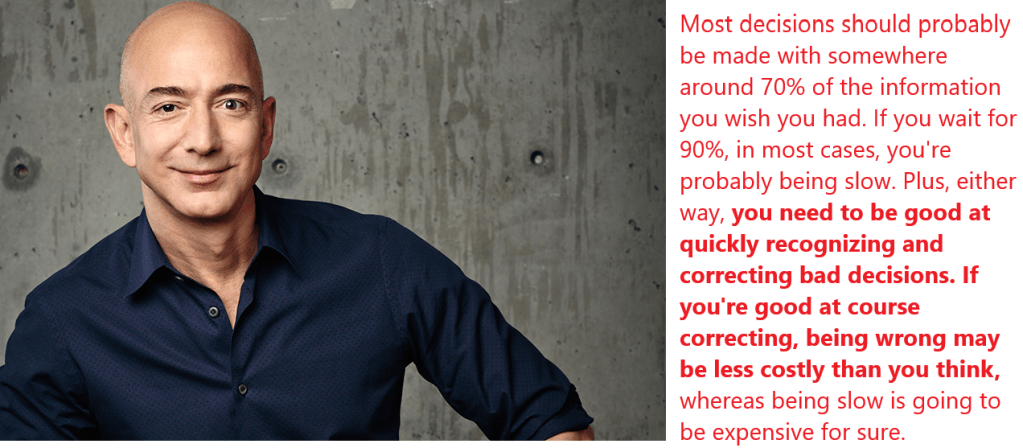

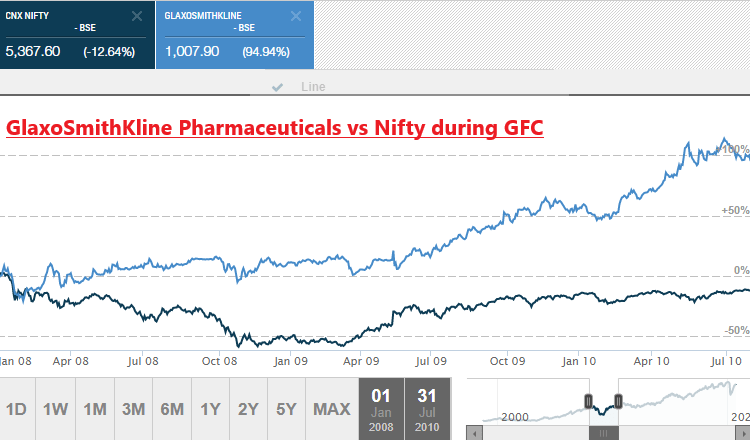

The above quote means you should always have cash available (loaded gun) to take advantage of opportunities, as and when, panicked sellers of assets (rare, fast-moving elephants) present you lucrative opportunities. With ample cash, one can always take advantage of panic sellers, when they rarely show up at times such as 2008-09 (Global Financial Crisis), the IL&FS crisis which led to a crash in Banking stocks in Sep-Oct 2018, or March 2020 (Covid-19 crash). Or one could also buy real estate with their own funds when real estate prices tanked for a little while, in March 2020. But how will you take advantage of fearful sellers if your ammunition has already been sucked up by home loan EMIs?

Personally I disposed off my only flat in 2012 because most of my life’s savings were in it and it’s price hadn’t kept pace with the interest on home loan being charged by my bank, for six years. When it was time to cut losses in my property, I simply followed Philip Fisher’s advice, who said this about money managers, who let their losses run.

I cut my losses, in that property, took the money from that sale and put some of it into a business and some of it into equities. And, it worked out better than I had expected. My family was initially reluctant with the idea of selling our first “own house” and some of my well wishers must have thought I’d gone bonkers to go against conventional wisdom, which was to keep paying interest on that home loan and hope for it’s market price to catch up with whatever I had already paid/would pay the bank in the near future. The same flat’s market price has not even doubled between 2012 and today, while my portfolio has done way better than that, both, before and after the covid19 flash crash.

That being said, in my view, the ideal time to buy a house is when you can buy it with 20% of your total corpus and with no help from any mortgage lender. The kind of mental comfort this kind of an arrangement can give you is difficult to explain in words.

Let’s talk about survivorship bias now. In an alternate universe, I might have been a trader who punted commodities on the London Metal Exchange or a guy who lost all the money he got from selling his house, in leveraged futures and options trades. In part, I was lucky to have read the right kind of people. I have a really bright friend who started about 2-3 years back and joined some day trader’s online course and is yet to break even. He eventually lost interest in the markets (at least temporarily), thanks to occasional losses and mounting responsibilities as he moved up the corporate ladder. My guess is he would have prioritised investments over his career, had he tasted success in the markets, by having chosen the right kind of mentors, when he started. And it wasn’t that he was not focused on learning technical analysis. He was. Just that he might not have found the right kind of mentors. My take away was to be careful about who you listen to. A mistake a lot of bright people in every field make, driven by the noise around, is to choose the wrong mentors. It takes 10x more time & effort to unlearn the wrong stuff than to learn the right ideas from the right people. Our brains are just wired that way.

To conclude the first part of this post, the key takeaways are:

- Keep your monthly cash outflows at bare minimum, by avoiding home loans. Rather stay on rent. Staying on rent is psychologically difficult, yet can be very profitable, in the long run, provided you are financially disciplined.

- If the market price of your property isn’t appreciating by at least 8%, then you are incurring permanent losses of valuable capital.

- Buy a house only when you can really & fully afford it with your liquid investments and without a home loan.

- If you are a DIY investor, choosing the right mentors with long track records and great testimonials is key.

In the next part, I will be covering how I think about asset allocation when it comes to leveraged real estate. Hope this post adds value to your life. Cheers!!

-Barath Mukhi

-12th January 2020