$10,000 invested in Apple in 2003 were worth about $1.5 Million in 2015.

In 2003, Apple was a $10 Billion co. Today it is worth a massive $1.8 Trillion. In the book, The Next Apple, the authors, Ivaylo Ivanhoff & Howard Lindzon, discuss ideas to find the next big winners, the next Apples of the world. Although, they discuss many factors, I will stick only to some points that I felt, formed the core of this book.

Despite some very scary recessions in financial history and gut wrenching volatility in stock prices, the market has consistently provided opportunities to invest in hundreds of stocks that went up 1000% or more.

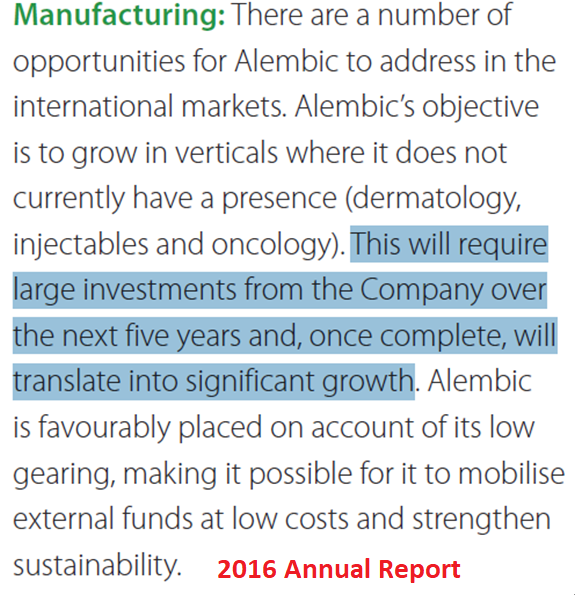

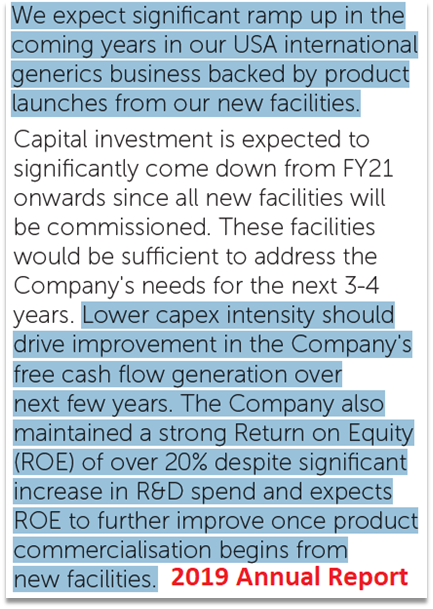

This was also the key lesson from the below book, a book that hit me like a train when I first read it a few years back.

Thomas Phelps convincingly argued, that between 1930s and 1970s, 365 American stocks went up a hundred fold. (You read that right, 365 stocks went up a 100x!!). And these were spread across a 40-50 year time period, which means there were a few stocks available every single year, which went up more than a 100x, over that time period. Just the names kept changing.

To quote some examples from the list, these were some stocks that went up a 100x across different time periods.

- Anheuser Busch (Budweiser Beer) – 1935 to 1971

- IBM – 1948 to 1971

- Kodak – 1933 to 1971

- Polaroid – 1955 to 1971

- Development Corp. of America – 1967 to 1971

- American Laboratories – 1964 to 1971

But what’s in it for us? Why is it important to study financial history? Because history is (sometimes) a reliable resource to make educated guesses about the future.

Mr. Buffett agrees.

What history tells us is that there are multi baggers in every single year. The good news is that over the next 10 years, in any 10 year period, there will be multiple stocks that will advance 10x, 50x, 100x or more.

Could Apple, become the next Apple, for us, the investors of today? If history is a guide, it’s very unlikely. As a co. becomes big, the law of big numbers catches up and co’s fail to maintain their growth rates. Fro any co. it is relatively easy double it’s customer base from a 100 customers to 200 customers than it is to go from 10 Crore customers to 20 Crore customers.

This means that the names of big winners change every 3 to 5 years, sometimes more often. But the good news is they take similar paths. Studying their identical patterns helps us in finding the next Apple, Infosys, Page Industries, Symphony, Titan or any other multi bagger stocks.

So how do we identify such stocks?

The author of The Next Apple rightly insists that the vast majority of big long term trends start with a breakout to new 52 week highs from a proper base, with each trend having varying underlying reasons. A proper base is something I am still working to figure out. But from the author’s description, seems like he means, 52 week highs with good volumes + consolidation.

Look at the 52 week high list

- Look at the 52 week high list. It is often a shortcut to the minds of smart investors. It could also be a reflection of people’s ignorance and stupidity. It takes some practice to learn to how to use it properly.

- Once you have identified a stock/sector from the 52 week high list, follow the thoughts of people with domain experience. You don’t need to know any people with domain experience personally in order to benefit from their wisdom as an investor. The beauty of the Internet and social media is that anyone has access to everyone’s brain for a marginal cost.

If you learn to do both, you are likely to catch quite a few of the biggest stock market winners.

The beauty of the stock market is that you don’t need to be the first or the original, to identify a trend. As the example of Apple & similar other stocks shows, you can be a bit late and still ride the trend by becoming a minority partner in wonderful, fast growing businesses.

Understand why the stock hit 52 week highs (52WH) or All Time Highs(ATH)

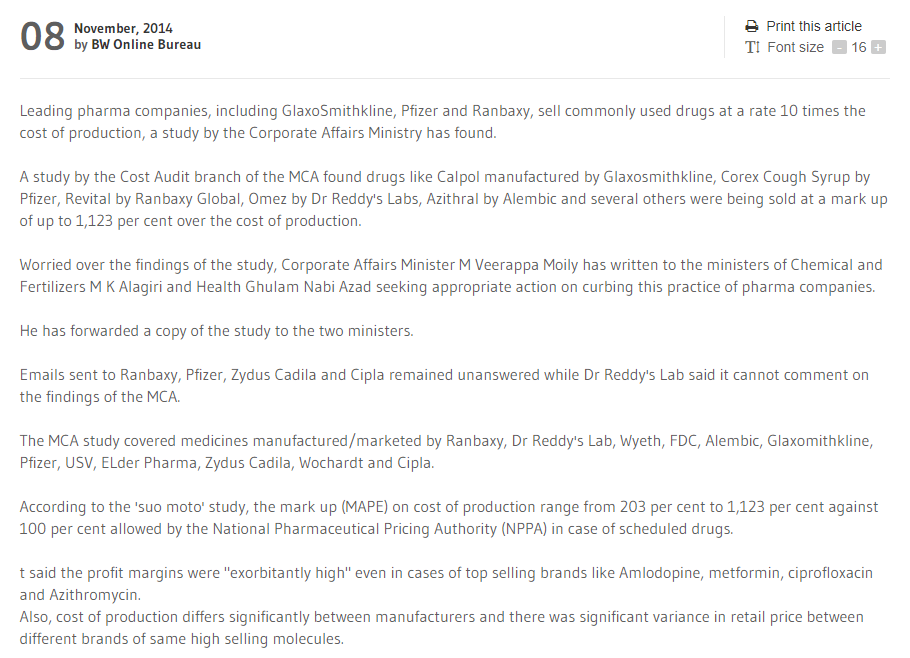

Now, hundreds of stocks hit 52 week highs every year. It doesn’t mean we go buy all of them. It means we become curious as to why a given stock hit a 52WH. If a trend is obvious (like the current pharma pack), and there is more steam left, then consider buying the stock. Hence, understanding the story behind the moves becomes critical.

Understanding the triggers behind a price move will give you the confidence to raise the stakes to meaningful levels.

“Sometimes, being a contrarian means staying with the trend.” – Steven Spencer

No one knows which ATH is the beginning or an end of a trend. No one knows how far or how long a trend could go.

Past performance could be an incredible source of investing ideas. Past performance, means 2 things:

1. Momentum – Stocks that outperformed in the past 3 to 12 months tend to continue to outperform in the next 3 to 12 months.

2. New 52WH – All long term stock market winners spend a considerable time on the 52WH list, if not the ATH list.

Why the 52 week high list is so important?

- We don’t want to be first. We want to be in stocks that move, and being on the 52WH list attracts a lot of attention.

- It is an important benchmark followed by many investors.

- You cannot make a cent before the market agrees with you. The market’s way of agreeing with you is sending your stock to the 52WH list.

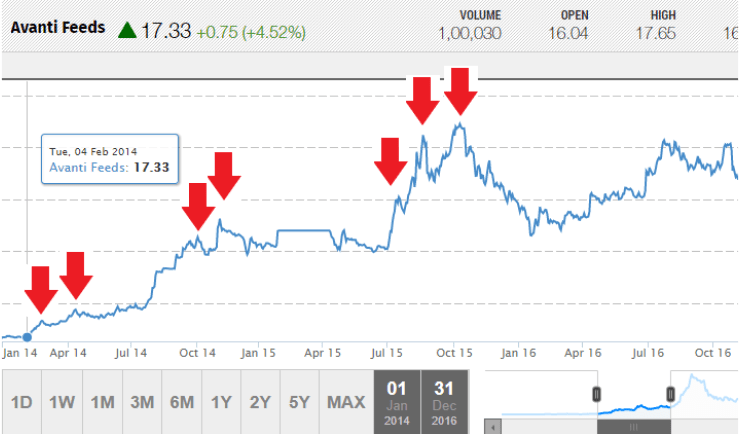

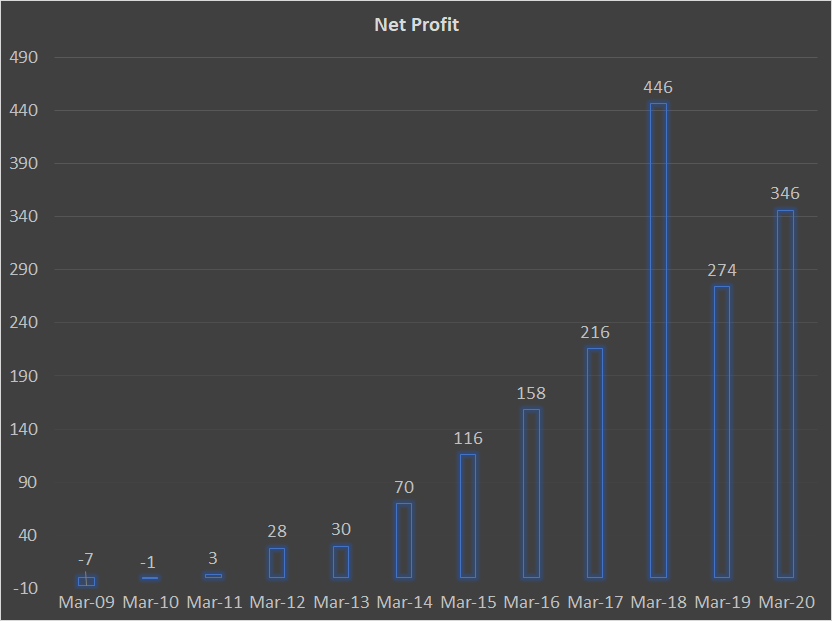

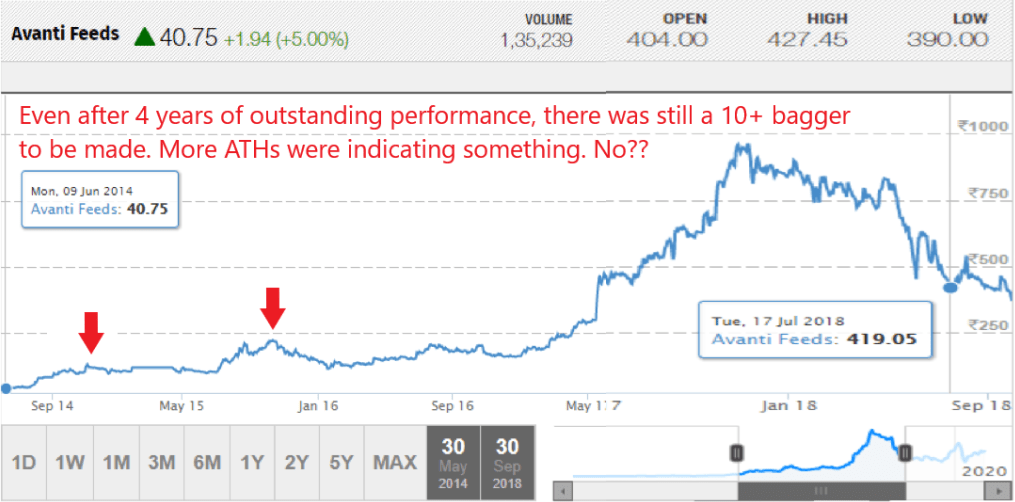

Take the example of Avanti Feeds, starting from March 2011, a stock which went from 3 bucks to 950 bucks, a 300+ bagger, at it’s peak in Oct 2017.

The arrows in the above charts show how many times this stock hit ATH, in it’s 300x journey.

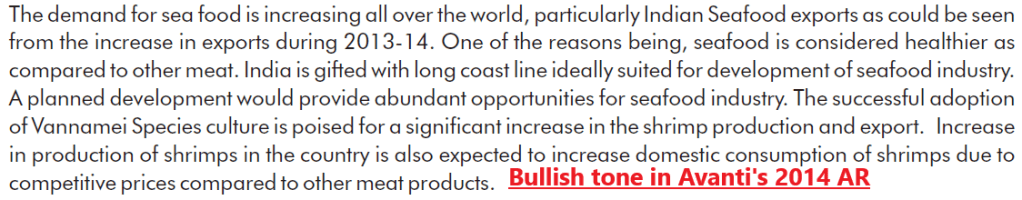

Now you may ask why did this happen? What triggered the very first ATH in this stock?

The answer is that the co. went from making a loss in 2010 to a fast grower. It’s profit zoomed like a rocket, thanks to all the tailwinds this shrimp feed business experienced.

Now even if one was late to the party by 4 years, and bought the stock a good 4 years later, in March 2014, he could have made a 10+ bagger (even after factoring the stock price crash in 2018.

Now, one could have validated the story from Avanti’s 2014 annual report and then taken a call. Despite the massive run up, the co. was still available at a market cap of 473 Crs, trading at 7 times FY 2014 earnings.

The same pattern played out in Ajanta Pharma.

Take the charts of any historical wealth creator and you’ll see the same pattern playing out. Multibaggers show up on the 52WH & ATH lists, time and again.

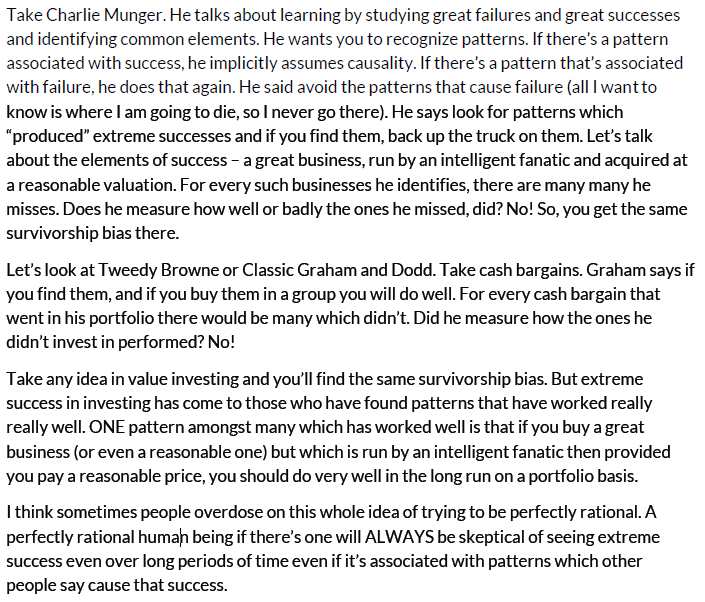

What about hindsight bias?

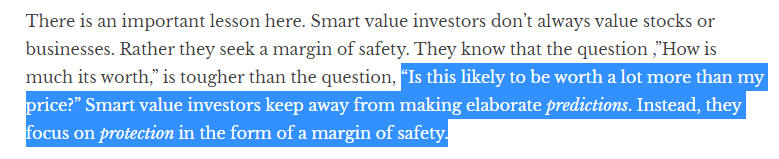

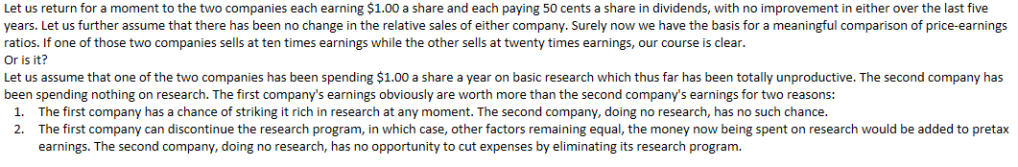

But isn’t all this hindsight bias and seem to be prone to judgemental errors? Prof. Bakshi once articulated nicely about how people overdose on being rational.

I think the point Prof. was trying to make was sometimes you have to decide whether you want to be rational or you want to be rich.

When it comes to learning from the past, it is ok to take a balanced approach and not overdose on hindsight and survivorship biases, while at the same time acknowledging the limitations of using historical data.

Should you go out and buy all the stocks on the 52WH or ATH list?

The answer is NO. But what it means is this should become your hunting ground for the next big winners in the market. It means you dig deeper into the catalysts that led to the stock showing up on that list. And if there are strong reasons to believe the story is likely to last a while, consider pulling the buy trigger.

When you’ve found out a good candidate amongst the 52WH list, other common sense rules of investing well, still apply. The main ones being business strength, management intelligence & integrity and buying growth & quality at a reasonable price.

Having a fundamental catalyst like a big earnings surprise behind a breakout to new 52WH improves substantially, the odds of finding a big winner.

What if you buy at the highest 52WH before the co. goes into oblivion?

Most trends last only a few quarters, but knowledgeable investors know how to take advantage of them and protect profits when the inevitable drawdowns come.

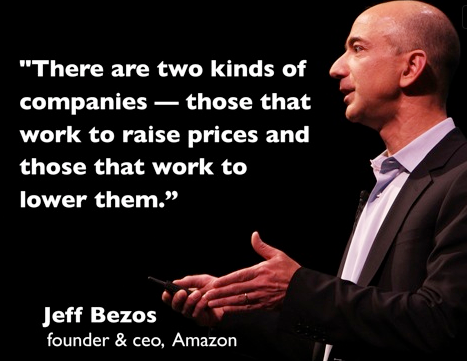

Assuming all other rules of common sense investing have been followed, if one still finds themselves in a falling stock, it is better to acknowledge his fault, cut losses quickly and move on to the next ATH or 52WH stock. At such times, it would be logical to follow the advice of the world’s smartest businessman.

Relative strength

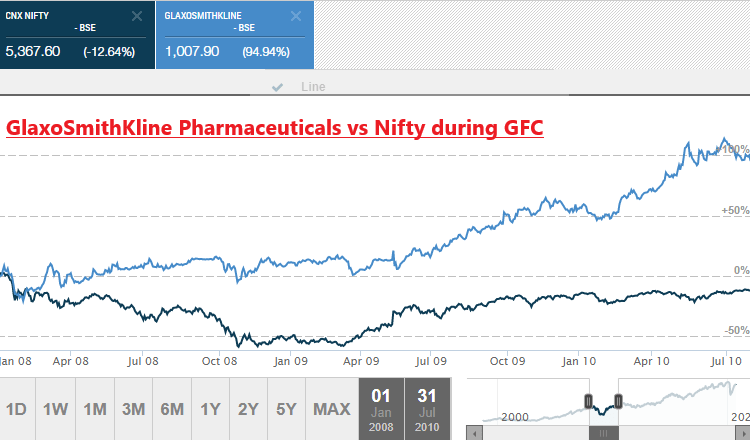

Another good idea in the book is that of relative strength. Particularly during market corrections, it is important to pay attention to stocks that exhibit relative strength. It is a simple concept. Look for stocks that go sideways, or even up, while the indexes bleed. Once the markets start recovering, these stocks tend to outperform.

The importance of this idea has been categorically highlighted by Ivan Hoff in Chapter 7 – “If you remember only one principle from this book, it should be the concept of relative strength.”

The below charts of Hero Motocorp, HUL & Glaxo speak for themselves.

Summary

- 52WH and ATH lists are an all important tool for idea generation.

- We cannot make a penny without Mr. Market agreeing with us and his way of agreeing with us it by sending our stocks to the 52WH & ATH lists.

- Big winners are found in every single year, every single bull market and every single bear market.

- All other rules of common sense investing still apply to buying at 52WH and ATHs.

- Don’t overdo rationality. Understand the trade-offs between being rational and being rich.

- Cutting losses rapidly is a given when buying 52WH stories. If gap downs happen, god help us.

- Relative strength is another very good tool to have in an investor’s toolkit.

-Barath Mukhi

-29th Sep 2020