Is the current rally in Pharma stocks like Alembic, Aarti & Laurus (current sector leaders & market favorites based on growth in sales & profits) being driven by supply chain disruptions due to Covid19 or is this a secular growth story we investors are looking at?

Will investors lose money yet again, chasing hot stocks of a sector, everybody’s talking about?

To the answer this question, lets look at the sales data for all 3 companies.

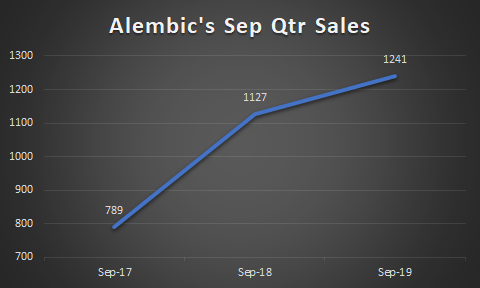

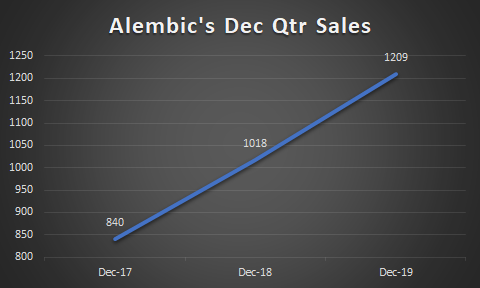

Alembic Pharma

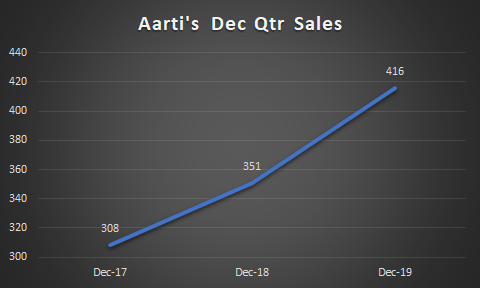

Aarti Drugs

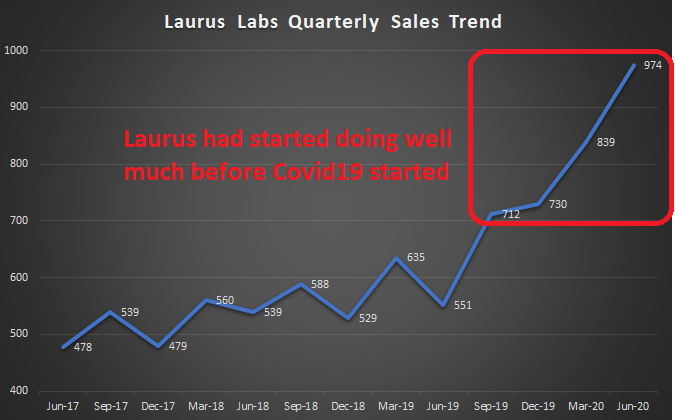

Laurus Labs

Conclusion

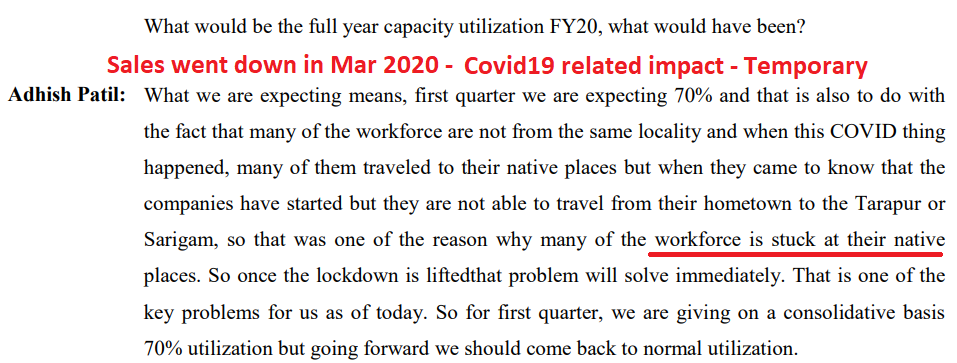

The consistent growth in quarterly sales of sector leaders from the API segment is suggesting that certain tailwinds are helping the API sector (Laurus & Aarti), and this is more likely to be a long term trend rather than a one-off jump in performance due to Covid19 disruption. As the above charts depict, both Aarti & Laurus started doing well, at least 2 quarters before Covid19 disrupted API supplies.

Meanwhile, Alembic started doing well (Most of Alembic’s sales come from Generic drug exports), due to it’s focus on R&D and strategizing well, much before Covid19 tailwinds came by.

I believe, (and could be wrong), all 3 companies are likely to do well over the short to medium term because of the reasons mentioned above.

Disclosure – I and my clients have substantial positions in Alembic Pharma and Laurus Labs and my views are certainly biased. As of 19th August 2020, I do not have a position in Aarti Drugs. This blog is not to be construed as an investment advice. Please consult your investment advisor before investing.

Disclaimer: This is NOT investment buy/sell/hold advise. I am not SEBI registered. May change stance on above businesses anytime with new developments and/or new insights, and/or overall market conditions. May NOT be able to update periodically. Please do your own diligence and/or take professional advise, before investing.

-Barath Mukhi

-19-Aug-2020