19th July 2020

Alkem Labs seems to be an upcoming investment opportunity in Pharma, a sector which has tailwinds in it’s favor, during the ongoing Covid19 situation. Here are my thoughts on why this company could turn out to be an interesting investment candidate.

Sales from various businesses in FY2020

The company’s Domestic as well as US businesses demonstrated good sales growth in FY2020.

Consistent growth in domestic as well as export portfolios

Overall sales trends over the years

PAT trends over the years

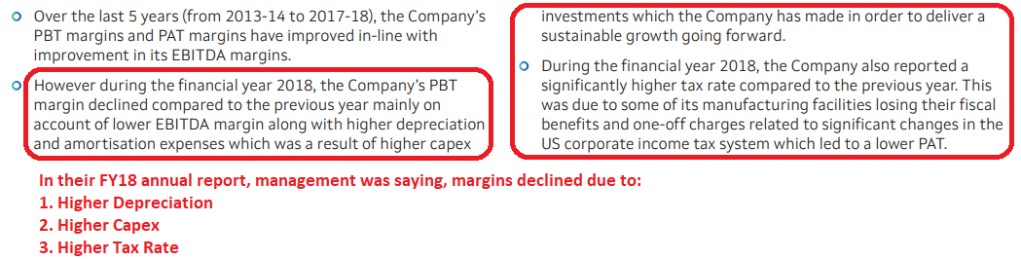

So, one may observe profits went down from 892 Crs in FY17 to 631 Crs in FY18. Let’s dig into why there was a drop of 261 Crs in FY18 despite Sales going up that year.

Snippet from the company’s FY2018 Annual Report

The company’s 2018 Annual report does show that their Tax expense increased from 60 Crs in 2017 to 287 Crs, an increase of 227 Crs. This tells us that a good chunk of the drop in profits was due to the increase in taxes.

Return on Equity – A good return on equity is at least twice the current AAA bond yield. Why? Because, over the long term, return from an equity share almost always equals the ROE delivered by the company. In the short to medium term though, PE expansion can deliver much more than ROE. So, if you are taking all those risks attached to equity investments, and you are investing for the long term, you should at least be demanding twice the risk-free return offered by government bonds. The current bond yield in India is about 6% & twice that would be 12%, which is the benchmark ROE one should look at.

Risks

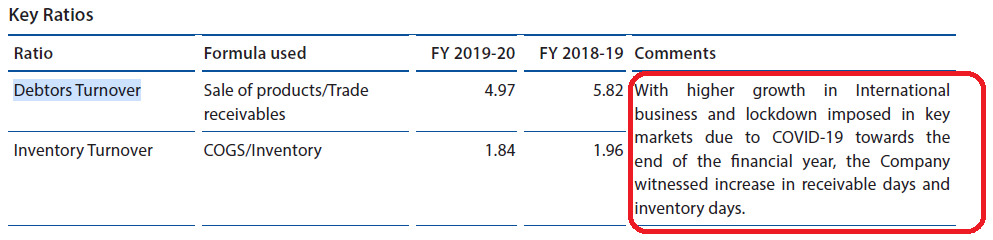

Credit sales for Alkem are on the rise. This is particularly critical for domestic focused companies like Alkem because the laws pertaining to collecting dues in India aren’t perceived to be as easy as collecting dues from customers based in developed countries, where the laws are more stringent.

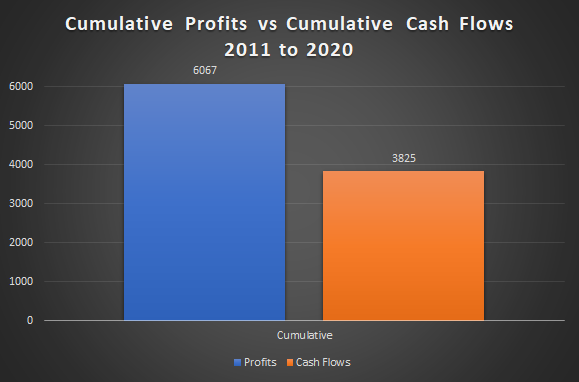

The company isn’t very good at converting profits into cash flows.

Let’s take a look at the Cash Flow Statement for FY2020

So as we can see, 21% of the company’s FY2020 profits went to receivables, 12% went to loans given and 23% went to inventories, resulting in profits not getting converted to cash flows. Just 52% of the company’s PAT was converted to cash and that’s not good.

The company’s FY2020 annual report offers some insights into their current status of receivables.

The company’s FY2020 annual report also states the potential impact of Covid19 on further issues with their cash collections (Increase in receivables from customers as well as a pile up of inventories in their warehouses)

The Case for high receivables

Now, one of the investors I highly respect, mentioned this recently – “Receivables in pharma sector usually don’t end up being bad debts and write offs because the relationships between the company and its clients are multi year and hence there is a lot of inter dependence.”

Conclusion

The company has been growing really well in both, domestic as well as international businesses along with a good return on equity.

Key surveillance items

- Receivables may further go up due to the impact of Covid19

- Domestic sales may get impacted due to the company’s sales team not being able to meet doctors

- Inventories pile up because of point # 2, further impairing the company’s working capital position, at least temporarily

Disclosure – No positions in this stock as of writing this blog. This is NOT investment buy/sell/hold advise. I am not SEBI registered. May change stance on above business anytime with new developments and/or new insights, and/or overall market conditions. May NOT be able to update periodically. Please do your own diligence and/or take professional advise, before investing.

-Barath Mukhi