Let me start with a story of a fanatic who creates a 20 thousand Crore company from scratch. How does he do it? Where does he start?

The story begins at Andhra, which by the way has produced quite a few successful first generation entrepreneurs in the Pharma space. The ones I know of, are Dr. Reddy’s, Divi’s & Laurus. I don’t know if it is plain randomness or there was something in that environment that led to creation of multi billion dollar pharma companies by people starting from scratch. I speculate, one of the factors, may have been the way chemistry was taught in those colleges, was better than other places.

Or maybe it was about being in the right place at the right time with the right skills. Maybe, in an alternate universe, the same set of entrepreneurs may not have done as well as they have. Too many things needed to fall in place for this kind of, what some people may call, coincidence. Reminds me of the experiment which is widely known on the net, through the article about Justin Timberlake.

One of the key ideas in this article was that too many things need to fall in place, and more importantly, at the same time, for a knockout success story to happen. For example, imagine what would have happened if the exact same set of people were to start Infosys today. Would they be nearly as wildly successful as they have been? Or what if Bill Gates was born just 5 years later? Would we nearly have another giant monopoly like Microsoft or anything close? You get the point.

Will Laurus (20k Crs Market cap) follow the same trajectory as Dr. Reddy’s (75k Crs Market cap) & Divi’s (1 lac Crs Market cap)? In my biased view, chances are it will.

So after finishing his education, Dr. Chava,

- Joins Ranbaxy as an R&D management trainee.

- Moves to Veera Laboratories in 1995 and runs the R&D dept.

- Moves to Vorin Labs which merges with Matrix Labs in 2001.

- Becomes Chief Operating Officer of Matrix in 2004.

- Starts Laurus Labs in 2005 due to differences with the chairman of Matrix.

How Matrix Labs strengthened it’s R&D – From Matrix Labs 2000 Annual Report

In 2000-2001, Matrix entered into drugs that treat the deadly AIDS disease. Here’s a snippet from Matrix’ 2001 annual report.

Matrix Labs 2003 Annual Report

Matrix Labs 2004 Annual Report

And here’s what happened at Matrix Labs during Dr. Chava’s tenure. Back then, this kind of growth might have been possible due to a mix of factors such as a growth in the overall industry + the management team driving the company’s focus on to the right products in the right markets, at the right time.

Now, let’s get into the current and future state of Laurus’ business.

In the past, growth was driven by sales of Antiviral APIs. This is the division that sells APIs for AIDS drugs, primarily in low and middle income countries through the Global Fund, PEPFAR and the WHO. A majority of ARV API sales growth came from 4 HIV/AIDS products – Tenofovir, Lamivudine, Efavirenz and Dolutegravir.

As per their latest concall, doubling sales in the HIV segment (APIs + Formulations) is going to be impossible. Having said that, they also mentioned, they should be able to deliver growth in their overall API business in FY22 as well. Based on whatever little info I could find, the largest player in ARVs seems to be Mylan (which acquired Matrix Labs in 2007), and has a 40% market share, in this space.

The other 2 therapies that management is bullish on, are Cardiovascular and Diabetes.

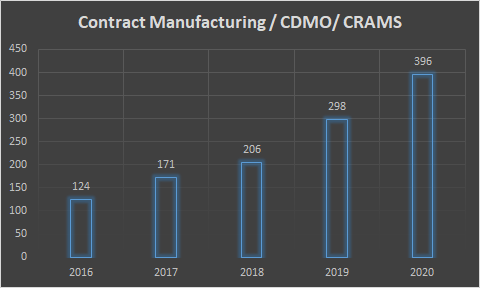

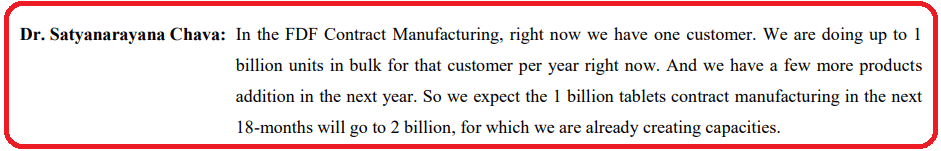

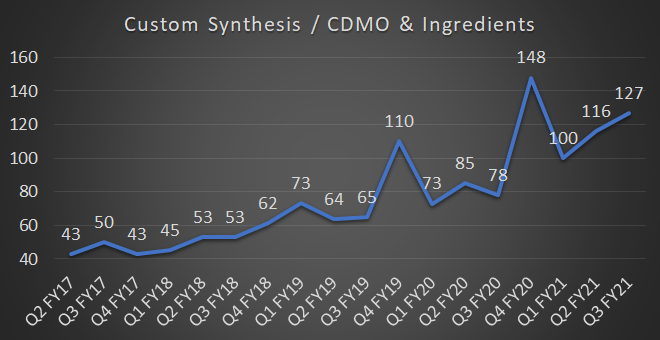

Some part of the growth was also driven Laurus’ Custom Synthesis, CDMO & Ingredients businesses. Custom Synthesis is the segment that has potential to do well over the next few years because the total sale from this division over the last 4 quarters is a minuscule 491 Crs.

Transforming into a full fledged Pharma player

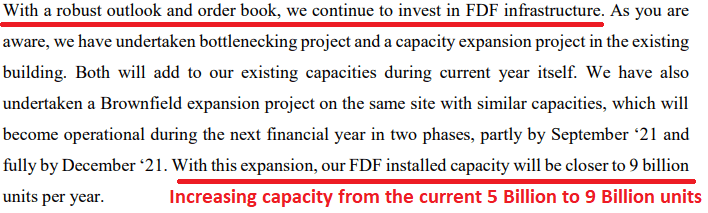

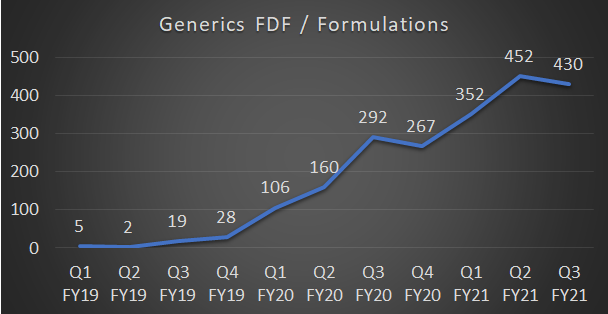

Formulations / FDF showed up for the first time in 2020 Annual Report.

Q3 FY 2021 Concall – “See, if you look at the evolution from 80% to ARV APIs, in the five years we moved to 38% of ARV APIs. Similarly, our revenue dependency on ARV formulations currently is very high. But in the next five years, we will also diversify our revenues coming from non-ARV formulations significantly and the dependence on ARV will come down. Because there are no new formulations to be developed in the ARVs, we are almost done with developments. So, development focus is shifting from ARV to non-ARV. And also, we are adding very large capacity in Vizag and we have taken land for formulations expansion in Hyderabad as well. So if you want to look at where we will be in say, three, four years down the line, I am sure we will be discussing on non-ARV in five years from now. If you look at the calls one and a half year back, half of the times people were asking questions on Efavirenz. Now nobody asks questions on Efavirenz. Two years from now people will not ask questions on ARV APIs. And maybe another two years from then people will not ask about ARV formulations, people may talk about what is we are doing in our Laurus Bio?, what growth we have in Laurus Bio?, what other therapy areas we will be focusing?, what kind of delivery dosage forms we are doing?. So, company s in the transformation phase, so we need time and we are very confident to expand our portfolio beyond just ARV.“

The SMILE pattern

This is a pattern noted by the famous investor, Mr. Vijay Kedia. He believes multibagger companies exhibit the following characteristics – Small in size (at least it was small when I started investing in this co.), Medium in experience, Large in aspiration and Extra large in market potential. I am of the opinion that the company has all 4 ingredients and is likely to scale up to the next level, from here.

Regarding aspiration, here’s a person who starts with a salary of a few thousands, moves on to lead the R&D division of another co. and goes on to create a $2.5 billion business in less than 2 decades. If this is not aspiration, what is?

Disclaimer: I have stayed invested in Laurus Labs from lower levels. These are my views and are not to be construed as investment advice. As always, please do your own research before proceeding to buy/sell.

Barath Mukhi

26th-Feb-2021